Event Insurance in Colorado

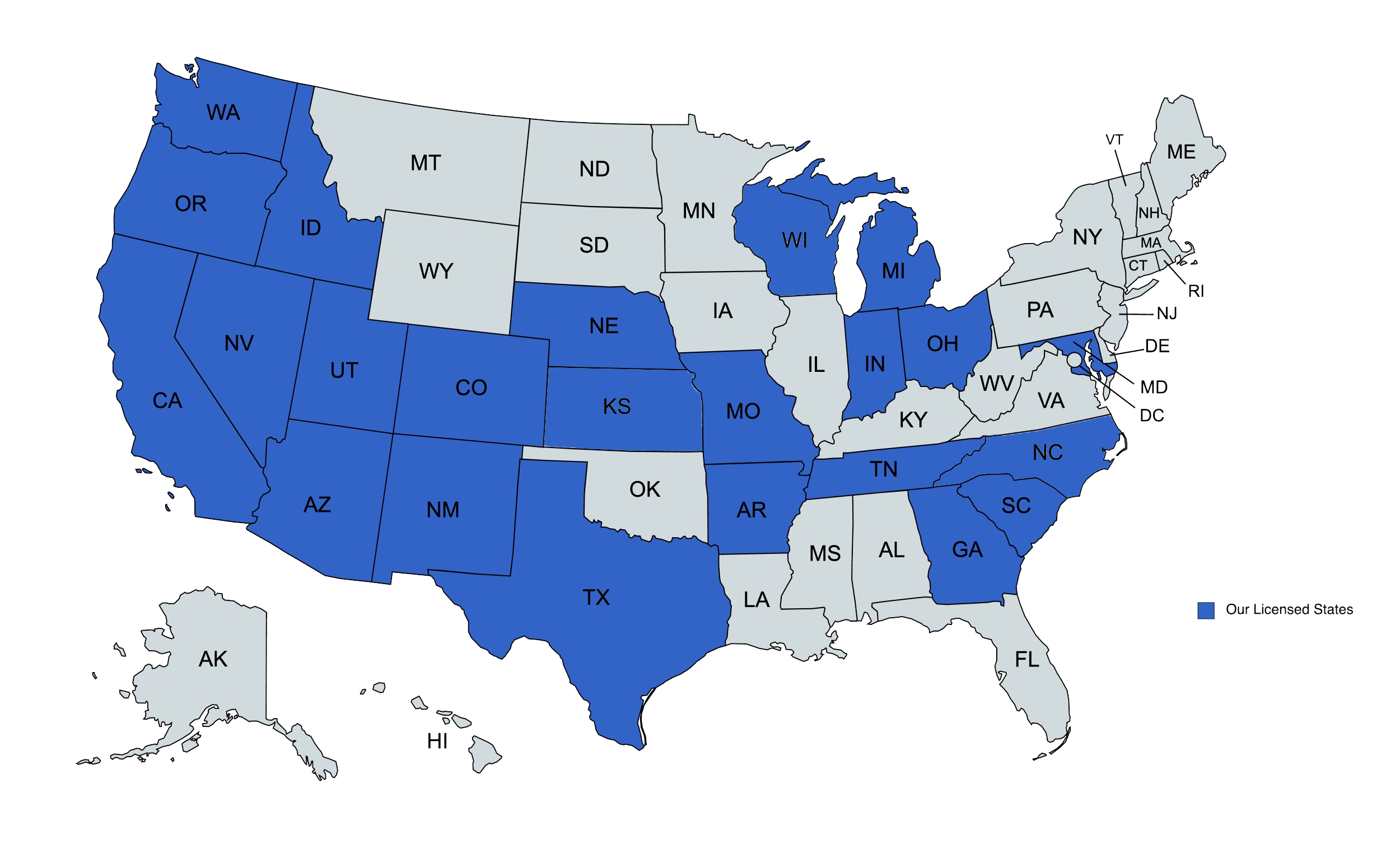

We provide event insurance solutions to businesses in Colorado and beyond.

Event Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is event insurance?

Putting on an event comes with certain risks, and it’s important to protect against those risks. Event insurance can give organizations hosting events in Colorado many of the protections they need.

Event insurance is a specialized type of policy for event organizers and sponsors. Policies may insure public or private events lasting anywhere from one day to several weeks.

What events taking place in Colorado need to be insured?

Most organizers hosting notable events should consider insurance. Not insuring an event that’s taking place in Colorado can result in devastating losses if something happens.

Businesses, nonprofit organizations, and even individuals might purchase these policies for many different events that they’re hosting. Policies are generally available for:

- Public festivals

- Company parties

- Grand openings

- Fundraisers

- Seminars

- Larger private gatherings

- Many other events

Get a Quote

“The team at Jump Suit was fantastic helping my insurance agency with our new responsive website. I highly recommend them to anyone serious about their business.”

“Jump Suit Group took my agency website and absolutely hit it out of the park! Now I have real inbound leads flowing through my website straight into my producer’s laps”

“I finally found an agency that cares about me. They delivered an incredibly sharp looking website that actually generates new business.”

What protections do event policies come with?

- General Liability Coverage: Usually for everyday accidents occurring during an event, including pre-event setup and post-event takedown. This could include incidents like slipping on ice, tripping on an extension cord, falling off a stage, or similar accidents. Most policies also cover property damage in these situations.

- Product Liability Coverage: Usually for injuries or property damages caused by products that are distributed or sold at the event. These could be foods, drinks, prizes, sold goods, free swag, or other products.

- Spectator Liability Coverage: Usually for injuries sustained by attendees while watching activities at the event. Coverage might apply to spectators watching any number of events, such as athletic competitions, live concerts, performances, airshows, or other happenings.

- Liquor Liability Coverage: Usually needed if alcohol is being served at an event. May cover incidents, including accidents, fights, assaults, and alcohol poisonings, that involve at least one over-intoxicated attendee.

- Automobile Liability Coverage: Usually needed if vehicles are used at the event. May be needed to insure shuttles or buses, security vehicles, and delivery vans and trucks.

- Medical Malpractice Coverage: Usually for errors made by medical staff who are hired to work the event. May be used to insure EMTs, paramedics, nurses, or physicians who provide care.

For specific activities like events with live animals or airshows, highly specialized protections are often recommended. An insurance agent who knows event policies well can assist with finding such coverages if they’re needed.

When should private gatherings be insured with event coverage?

While small, casual gatherings like birthday parties may not require event insurance, larger private events like weddings, milestone birthdays, large baby showers, or graduation parties might warrant coverage. These can bring significantly more risk, as there are more guests who attend.

An insurance agent who understands event policies can help you evaluate the risks associated with hosting larger gatherings, and then determine whether you should get coverage for your gathering. The agent can also assist with finding an affordable policy should you decide to get one.

What does ‘additional insureds’ mean in event policies?

An ‘additional insured’ is a party that’s added to the event insurance policy. Being added normally allows the party to file a claim against the policy, even though they aren’t the actual policyholder. Event organizers may need to add venues, major vendors, or others as additional insureds. This is something that a knowledgeable agent can assist with.

How affordable is one-day event insurance?

The cost of one-day event insurance is generally quite reasonable, although it varies based on the type of event and associated risks. An independent insurance agent can check what different insurers would charge to cover a specific one-day event.

Where can organizers of events in Colorado get event insurance?

If you’re involved with an event that’ll take place in Colorado, contact the independent insurance agents at The DeLuca Agency. Our agents will walk you through the event insurance options that are available, and help you choose the one that’ll best cover your event. Together, we can make sure you’re well-protected throughout the entire event, and also during any setup or take-down period.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com