High Value Home Insurance in Colorado

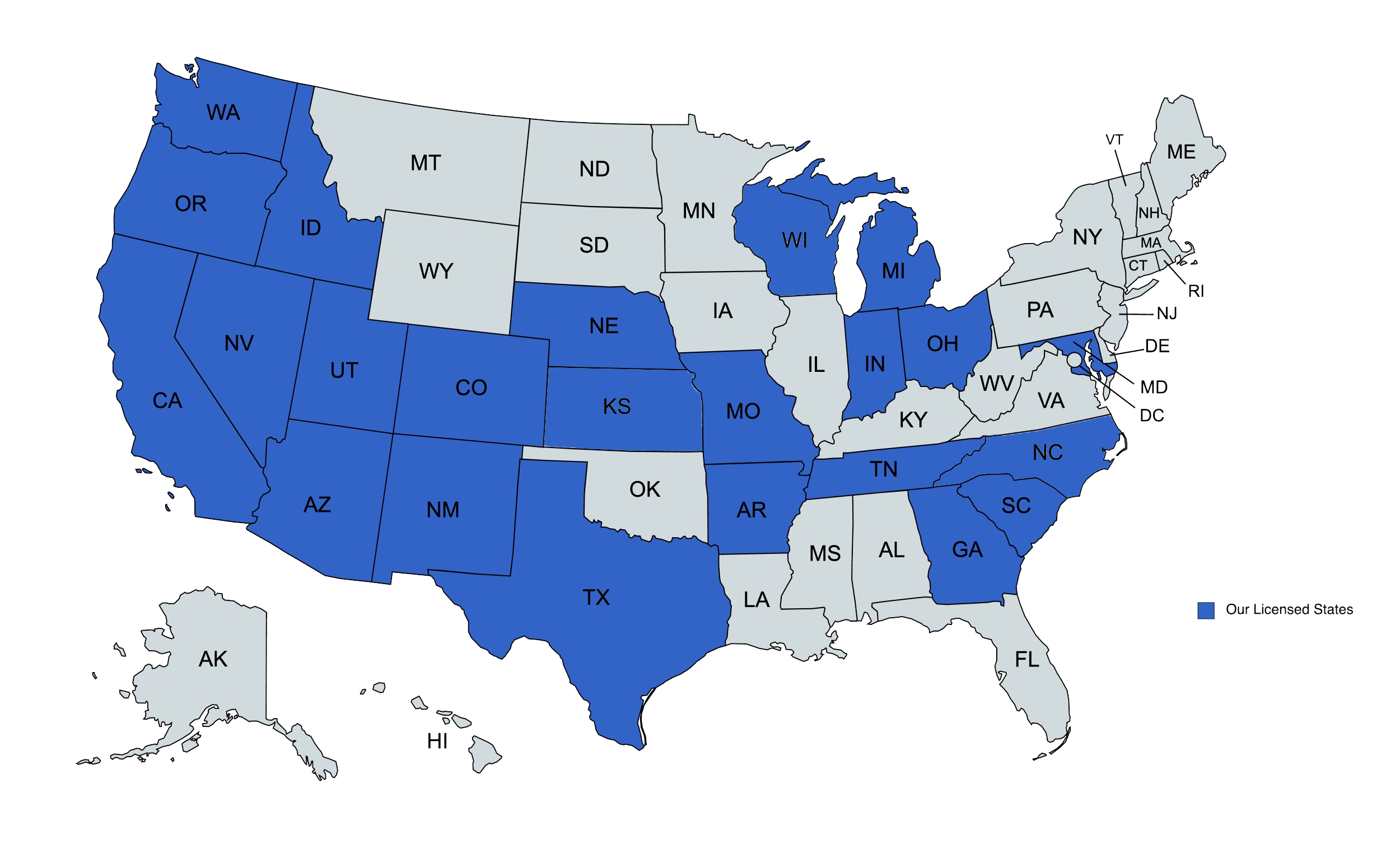

We provide high value home insurance solutions to residents in Colorado and beyond.

High Value Home Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is high value home insurance?

Owning a high-end home comes with some additional insurance considerations. When a standard homeowners policy isn’t sufficient for an Colorado residence, there’s high value home insurance.

High value home insurance offers protection that goes beyond the standard coverages. It has those, certainly, but also much more.

Who in Colorado does high value homeowners insurance make sense for?

High value homeowners insurance may be right for Colorado residents who have a more expensive home and want extra protections. Most policies are for homes valued around at least $750,000-$1 million. This isn’t a hard-and-fast criterion, though, as some policies are available for homes costing a few hundred thousand.

In a few situations, this type of policy could be advisable even for high income earners even if they don’t have a particularly expensive house. The other protections that these policies can offer go beyond just protection for a home, potentially offering other protections that high income earners want.

Anyone who isn’t sure whether they should get a standard or high value homeowners policy should talk with an insurance agent who knows these policies well. A specialized homeowners agent will be able to help decide which is the best option for a particular situation.

Get a Quote

“The team at Jump Suit was fantastic helping my insurance agency with our new responsive website. I highly recommend them to anyone serious about their business.”

“Jump Suit Group took my agency website and absolutely hit it out of the park! Now I have real inbound leads flowing through my website straight into my producer’s laps”

“I finally found an agency that cares about me. They delivered an incredibly sharp looking website that actually generates new business.”

What protections should homeowners look for in high value homeowners policies?

High value homeowners insurance policies can build upon the protections that standard homeowners policies offer. You can expect a diverse array of common and less common coverages in these policies.

Some of the more common coverages that are still important include:

- Dwelling Coverage: Usually insures the main residence on a covered property, providing protection against many causes of damage or destruction. The perils that a high value policy offers may be more extensive than what a standard policy covers.

- Other Structures Coverage: Usually insures additional structures located on the property such as guest houses, gazebos, sheds, detached garages and boathouses. The sizes and types of buildings that high value policies can cover may be more than standard policies will insure, and high value policies might cover more perils.

- Personal Property Coverage: Usually insures personal belongings, often including items like clothing, books, furniture, antiques, electronics, jewelry and collectibles. High value policies may offer more coverage for particularly expensive items or collections.

- Coverage for Rebuilding to Code: Usually insures against potential additional costs required to rebuild a home so that it’s in compliance with current building codes.

- Sewer Backup Coverage: Usually insures against damages sustained because of plumbing-related issues, often including incidents like leaking or burst pipes.

- Personal Liability Coverage: Usually insures against basic personal liability lawsuits, typically providing protection for the homeowner and their family.

Some coverages that aren’t in many standard homeowners policies, but in many high value homeowners policies include:

- Vacation Home Coverage: May cover additional residences, such as second, third, or fourth homes, whether located in Massachusetts or other places.

- Refrigerated Food Coverage: May cover perishable food items that spoil due to covered incidents, often including power outages and electrical surges.

- Kidnap and Ransom Coverage: May cover costs associated with domestic or international kidnapping and ransom situations.

- Cyber Coverage: May cover online threats, offering protection from risks such as phishing scams, hacking attempts, and ransomware demands.

How do insurance companies conduct valuations for high value residences?

Insurance companies sometimes conduct fairly in-depth valuations for houses that are insured with high value homeowners policies. Insurers regularly check comparable sales, local market trends, and similar data. In certain situations, an on-site inspection by an adjuster might be required.

The purpose of this research is to accurately value a home, so limits and premiums can be applied accordingly.

Where can Colorado residents find a high value home insurance policy?

If you want to learn more about how a high value home insurance policy could protect your house, contact the independent insurance agents at The DeLuca Agency. We can help you determine whether this is the right insurance for your Colorado home, and then work with you to find the best policy assuming it is the right option.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com