Landlord Insurance in Colorado

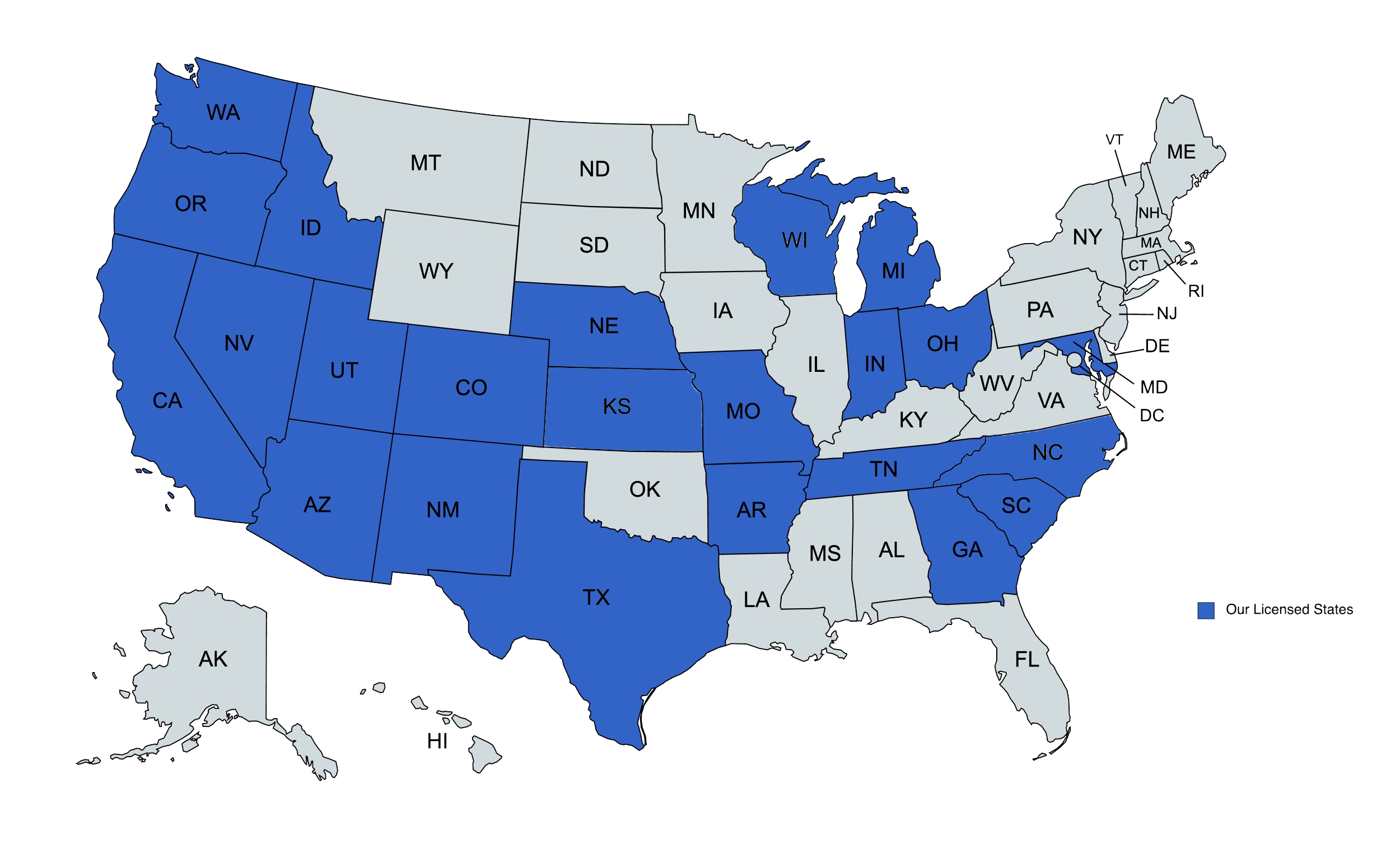

We provide landlord insurance solutions to businesses in Colorado and beyond.

Landlord Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is landlord insurance?

Rental properties can be damaged by many perils, and accidents on properties can lead to liability lawsuits. To help protect against such risks, landlords in Colorado can get landlord insurance.

Landlord insurance provides specialized coverages for renting properties. Policies may protect buildings, equipment, income, and even the landlord themselves.

Which Colorado landlords should have landlord liability insurance?

Most landlords with properties in Colorado should carry landlord liability insurance. Property insurance is strongly recommended for individuals and businesses leasing residential properties, too.

If you rent a single-family house, townhouse, condominium, duplex, triplex, or quad-plex, you should probably have this type of insurance. Other policies, such as apartment insurance, are normally recommended for properties with five or more units.

Get a Quote

“The team at Jump Suit was fantastic helping my insurance agency with our new responsive website. I highly recommend them to anyone serious about their business.”

“Jump Suit Group took my agency website and absolutely hit it out of the park! Now I have real inbound leads flowing through my website straight into my producer’s laps”

“I finally found an agency that cares about me. They delivered an incredibly sharp looking website that actually generates new business.”

Can a landlord policy cover commercial or mixed-use real estate?

Landlord policies are primarily designed for smaller residential properties. These policies typically don’t provide the coverages that a commercial or mixed-use property would require. For those, other policies are usually recommended.

What types of coverages are included in landlord policies?

Landlord policies may come with a variety of coverages, which protect against various property, liability, and other risks. Some specific protections that policies often make available are:

- Property Damage Insurance: Normally for the rental property itself. Often also can cover items on the property, like lawn equipment, appliances, window treatments, HVAC systems, and furniture in furnished units.

- Landlord Liability Insurance: Normally for lawsuits filed after someone, typically a tenant or their guest, is injured on the property. Might also protect against some other liability lawsuits.

- Legal Assistance Insurance: Normally for covering legal fees not associated with liability suits. For example, it might pay lawyer and court fees incurred during an eviction or judgment process.

- Loss of Rental Income Insurance: Normally for income losses when a disaster makes a property temporarily uninhabitable.

- Rent Guarantee Insurance: Normally for income losses when tenants fail to pay their rent.

- Commercial Umbrella Insurance: Normally affords an extra layer of liability protection, usually applying if a lawsuit exceeds the landlord liability insurance limit.

Do landlord policies include protection against water damage?

Whether a landlord policy insures against water damage depends on the policy, and the cause of damage.

Some landlord policies offer protection against burst pipes, overflowing toilets, and other in-building plumbing failures. This is a common option, although landlords might have to specifically add it if they want the coverage.

Landlord policies normally don’t offer protection against floods or mudslides. If protection against this type of water damage is desired, a separate flood insurance policy is likely needed.

An insurance agent who specializes in residential investment properties can help make sure a property is well insured against water damage. They should be able to assist with customizing a landlord policy, and getting a separate flood policy.

Does homeowners liability insurance cover lawsuits filed by tenants?

The personal liability coverage that’s included in most homeowners policies is unlikely to cover a lawsuit that a tenant files. Homeowners policies are intended for personal risks, which generally don’t include renting out an investment property.

The one exception might be short-term rentals on platforms like Airbnb. A homeowners policy (or the platform’s policy) might offer coverage for short-term rentals that are in your personal residence. Whether coverage for such rentals is proved depends on the particular policy.

When leasing traditional investment properties, however, a landlord policy is normally needed to protect against potential tenant lawsuits.

Can one landlord policy cover multiple properties?

Many insurance providers offer landlord policies that can cover multiple properties. A knowledgeable insurance agent can confirm that a policy is able to insure more than one policy.

Can a landlord policy cover a tenant’s possessions?

Landlord policies are intended for the landlord, and typically don’t cover a tenant’s personal property. In most cases, tenants should be encouraged to obtain their own renters insurance. Some landlords even require this.

Where can landlords with properties in Colorado find landlord insurance?

If you need insurance for one or more Colorado rental properties, reach out to the independent insurance agents at The DeLuca Agency. We’ll work closely with you to find a landlord insurance solution that’ll provide solid protection for your properties, and also for yourself.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com