Liquor Liability Insurance in Colorado

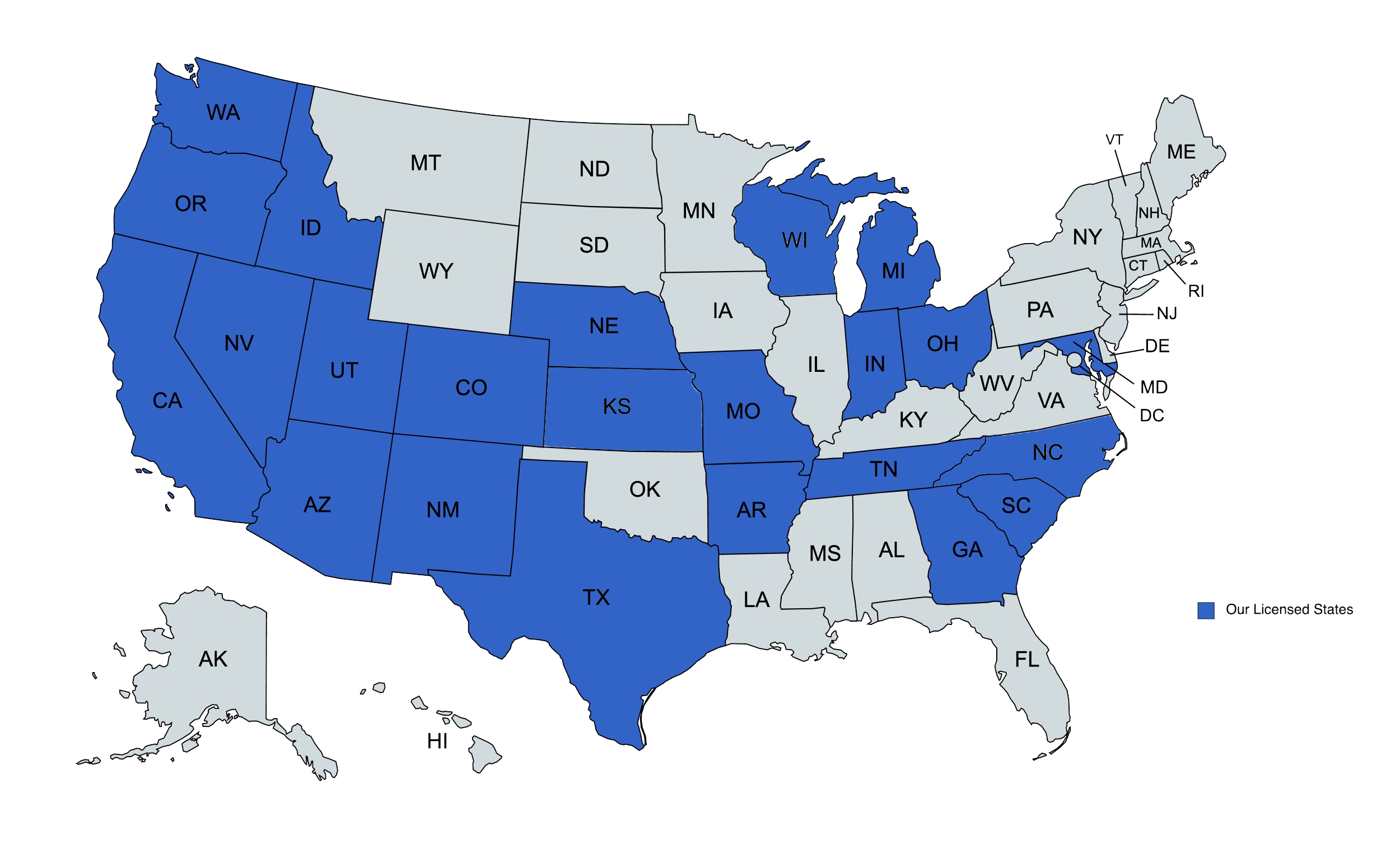

We provide liquor liability insurance solutions to businesses in Colorado and beyond.

Liquor Liability Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is liquor liability insurance?

Selling alcohol generally comes with risk, as businesses might be held liable if their customer is involved in an accident or other incident. Liquor liability insurance may help protect Colorado alcohol retailers from this risk.

Liquor liability insurance generally protects against various incidents that involve overly intoxicated customers. If there’s a covered claim, a policy usually pays legal costs and any settlement.

What alcohol retailers in Colorado need liquor liability coverage?

Most Colorado retailers selling alcohol should have liquor liability coverage. Policies are commonly purchased by liquor stores, bars, nightclubs, restaurants, and organizations hosting events. Bed & breakfasts might also need coverage.

Businesses that manufacture, wholesale, or import alcohol generally need liquor liability coverage too, but they often purchase a slightly different policy.

An insurance agent who specializes in this industry can help businesses select a liquor liability policy that’s right for them.

Get a Quote

“The team at Jump Suit was fantastic helping my insurance agency with our new responsive website. I highly recommend them to anyone serious about their business.”

“Jump Suit Group took my agency website and absolutely hit it out of the park! Now I have real inbound leads flowing through my website straight into my producer’s laps”

“I finally found an agency that cares about me. They delivered an incredibly sharp looking website that actually generates new business.”

What types of incidents does liquor liability coverage apply to?

Liquor liability coverage might protect against a range of incidents where intoxicated customers are involved. Depending on a policy’s terms, covered incidents could include:

- Accidents where an intoxicated customer is injured (e.g. slip and fall)

- Assaults by an intoxicated customer (e.g. sexual or other assault)

- Public brawls, either onsite or outside, involving intoxicated patrons

- Auto accidents involving intoxicated customers after they leave

- Hospitalizations for alcohol poisoning

Does liquor liability coverage include protection for incidents occurring off-premises?

The liability that comes with serving alcohol doesn’t necessarily end when a customer leaves a business’s property. The business might still be held partially responsible if a customer assaults someone, causes a car accident, is eventually hospitalized for alcohol poisoning, or in certain other situations.

If a business served beverages that contributed to a customer’s intoxication, the business might be sued regardless of where something occurs.

Thus, it’s important to make sure that a liquor liability policy extends protection to incidents occurring off-premises. Many policies do, but this should be confirmed by an insurance agent who’s familiar with the details of liquor liability coverage

Does general liability insurance cover claims involving intoxicated customers?

General liability insurance usually isn’t an adequate substitute for liquor liability coverage. While general liability may cover common accidents, it often excludes such accidents when the injured person is intoxicated. It also normally doesn’t apply to assaults, brawls, post-leaving car accidents, or alcohol poisoning.

For risks involving intoxicated customers, businesses usually need liquor liability coverage.

Does liquor liability coverage still apply if a customer is underage?

Serving underage customers often voids a liquor liability policy’s coverage. Insurance isn’t an excuse to not follow laws. Businesses are normally still responsible for making sure all customers served alcohol are of legal drinking age.

Can liquor liability coverage be combined with general liability insurance?

Yes, liquor liability coverage can often be bundled with other types of insurance. It’s commonly purchased along with general liability and other coverages, as part of a commercial package policy.

How much does a liquor liability policy cost?

What businesses pay for liquor liability coverage varies, based on factors like:

- Type of business

- Type of alcohol sold (i.e. wine and beer, or liquor)

- Percentage of sales coming from alcohol

- Annual revenues

Any recent insurance claims can increase costs somewhat. An independent insurance agent can check exactly how much a business would pay for coverage. Independent agents are able to check quotes from several insurance companies.

How can Colorado retailers and restaurants get liquor liability insurance?

If your business needs liquor liability insurance, reach out to independent insurance agents at The DeLuca Agency. Our agents will work with you to identify specific coverage, deductibles, and limits that work for your Colorado business. We’ll then find you a liquor liability policy that meets those needs well. Together, we can make sure your business is protected.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com