RV Insurance in Colorado

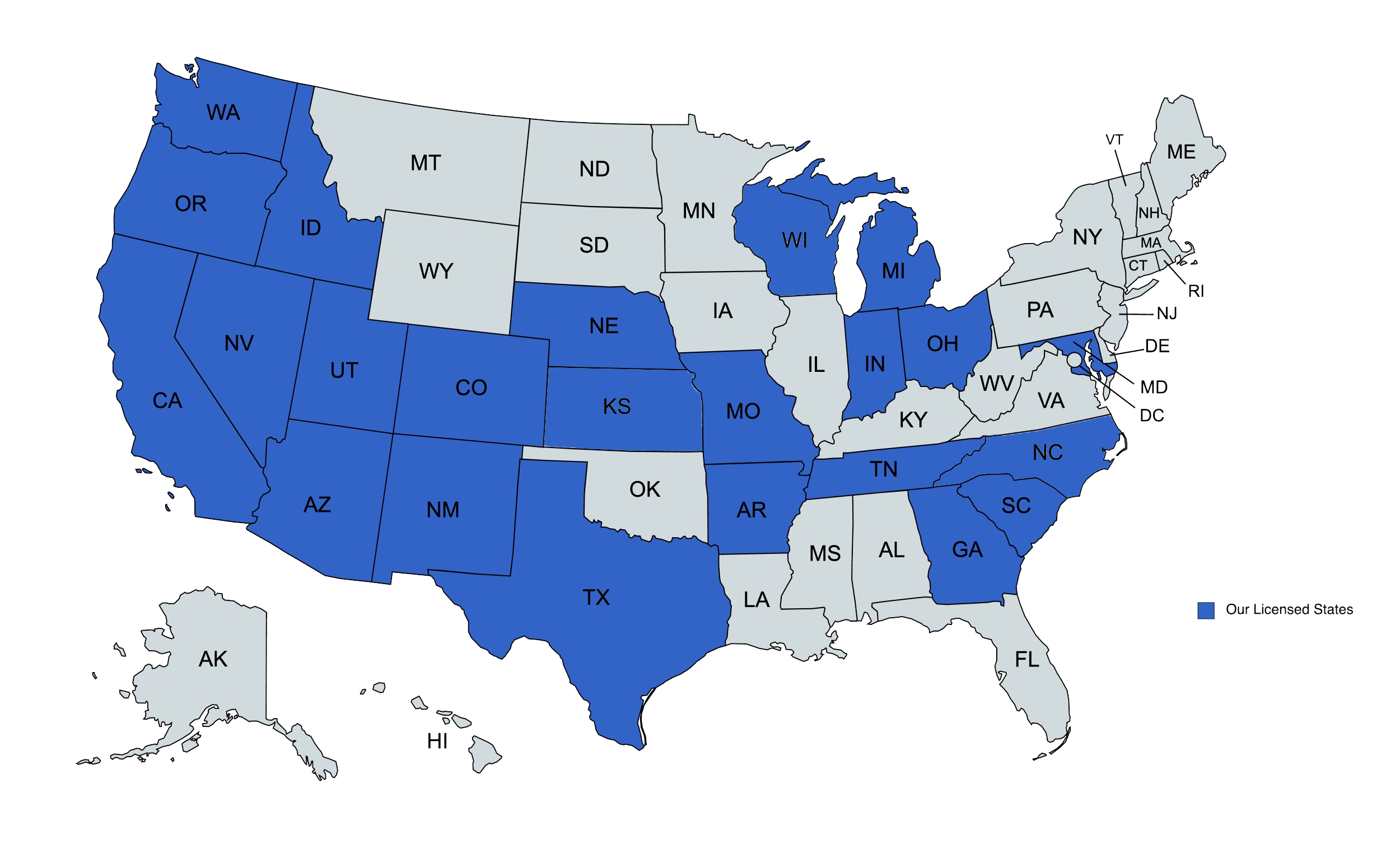

We provide RV insurance solutions to businesses in Colorado and beyond.

RV Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is RV insurance?

Motorhomes generally need to be insured when they’re on the road, but most standard auto insurance policies aren’t able to insure these vehicles. Their size, weight, and features normally require that Colorado residents who own motorhomes get RV insurance.

RV insurance provides tailored coverage for motorhomes and similar vehicles. While these policies are akin to auto policies in some ways, their coverages take into account the uniqueness of RVs.

Which Colorado drivers need to have a motorhome insurance policy?

Most Colorado drivers who own an RV should have motorhome insurance. State law normally requires coverage when driving, and other coverages for when an RV is parked are broadly recommended.

Get a Quote

“The team at Jump Suit was fantastic helping my insurance agency with our new responsive website. I highly recommend them to anyone serious about their business.”

“Jump Suit Group took my agency website and absolutely hit it out of the park! Now I have real inbound leads flowing through my website straight into my producer’s laps”

“I finally found an agency that cares about me. They delivered an incredibly sharp looking website that actually generates new business.”

What insurance coverages does motorhome insurance come with?

Motorhome insurance policies can offer a range of coverages. Some are similar to what’s found in a typical auto insurance policy, although the terms may be adjusted for an RV rather than a car. Other coverages are more particular to RVs.

The coverages that are similar to standard auto insurance protections include:

- Personal Injury Coverage: Could protect against injuries that are sustained by occupants in the RV, during an accident.

- Bodily Injury Liability Coverage: Could protect against injuries that are sustained by those not in the RV, such as occupants of other vehicles and pedestrians.

- Collision Coverage: Could protect against damage to the RV that occurs during an accident involving at least one other vehicle.

- Comprehensive Coverage: Could protect against damage to the RV that occurs due to non-collision risks, which might include theft, fire, hail, animals, and falling trees.

- Property Damage Liability Coverage: Could protect against damage that other vehicles or property sustain during an accident with the insured RV.

- Gap Coverage: Could protect against the financial difference between the RV’s market value and the outstanding balance on a loan, if the RV is totaled in a covered collision or another covered event.

- Underinsured/Uninsured Motorist Coverage: Could protect against collisions involving drivers who are either uninsured or underinsured, along with hit-and-run collisions.

Some of the other coverages that are more particular to RV policies include:

- Personal Property Coverage: Usually for insuring belongings kept within the RV, possibly including computers, cameras, dishes, books, souvenirs, and clothing.

- Emergency Travel Coverage: Usually for covering unexpected expenses if a trip is disrupted by a covered event, often paying for immediate lodging and meals.

- Vacation and Campsite Liability Coverage: Usually for insuring against accidents (non-vehicle) that occur in or around the RV, when it’s parked and set up for living.

- Full-Time RV Coverage: Usually for full-time RVers who don’t have a primary residence outside of their motorhome.

Do motorhome owners need to insure their RVs when not traveling in them?

While coverage needs might change when an RV isn’t being used, outright canceling coverage altogether generally isn’t recommended.

To cancel coverage altogether is to leave an RV uninsured against damage. That can result in major repair costs if something happens to the RV while it’s in storage. It might also be against the terms of a loan, as many lenders require certain coverages to insure a financed RV against damage.

Instead, a better option is usually to adjust coverages when putting an RV into storage. Coverages that truly aren’t needed can be dropped, while those that are required and/or protect against damage can be retained. This normally reduces a policy’s premiums yet also can protect against damage. Coverages can then be reinstated when it’s time to take the next road trip.

What other types of recreational vehicles may need insurance?

When you think of RVs, you’re mainly thinking motorhomes and campers, but other recreational vehicle types can also benefit from insurance. For these expensive “toys”, insurance is important for covering potential damages, theft, liability, and accidents. Examples of other recreational vehicles include:

- Truck Campers

- eBikes

- Golf Carts

- ATVs

- Jet Skis

- Snowmobiles

Where can motorhome owners in Colorado get RV insurance?

If you need assistance with insuring an RV or motorhome that’s registered in Colorado, contact the independent insurance agents at The DeLuca Agency. Our agents will work with you to determine coverage needs, and then help you find an RV insurance policy that meets your needs well. Together, we can make sure your RV is protected whether on or off the road.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com