Surety Bonds in Colorado

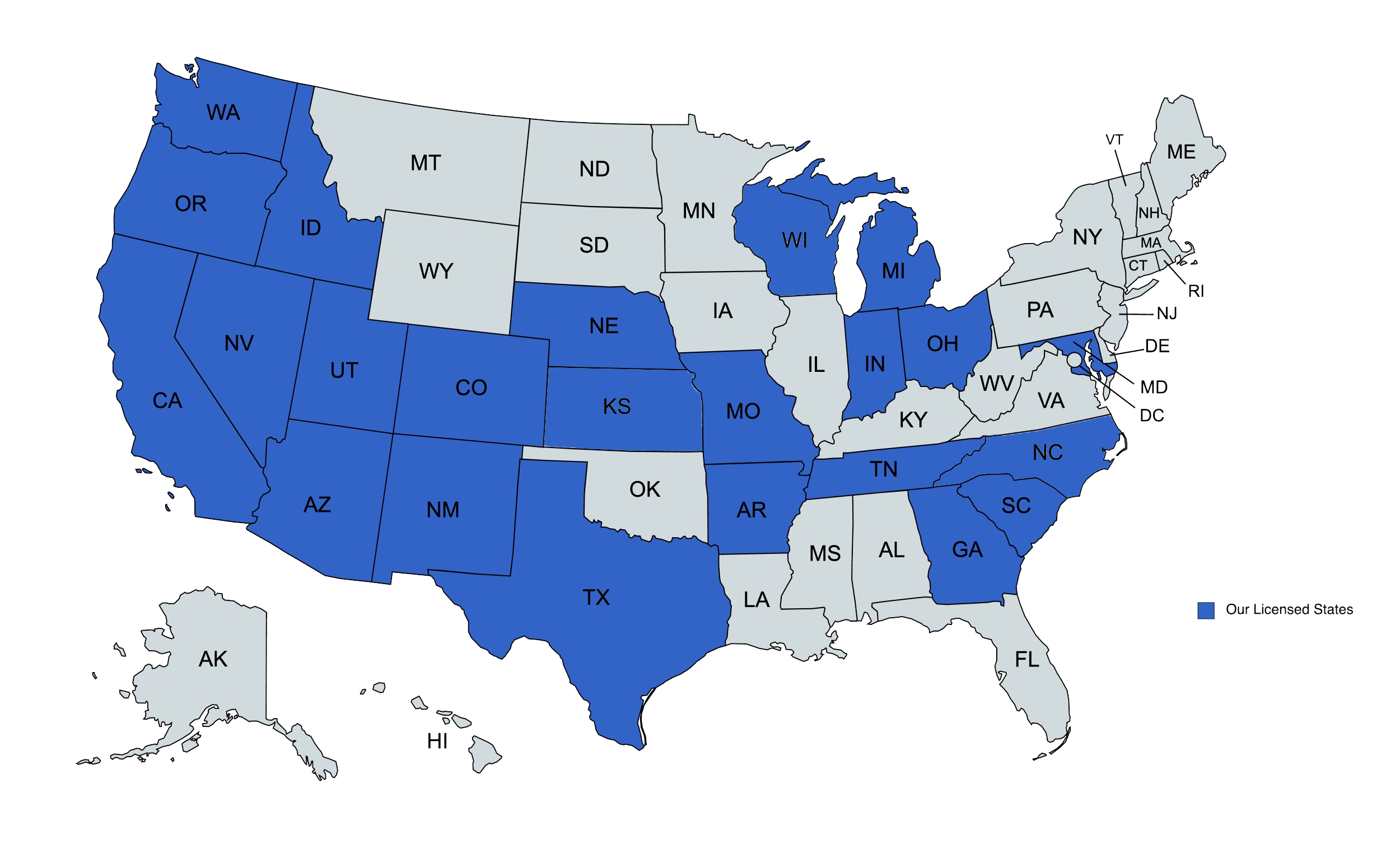

We provide surety bonds solutions to businesses in Colorado and beyond.

Surety Bonds at The DeLuca Agency and Denver Insurance Brokerage Inc

What are surety bonds?

Sometimes assurance beyond a business’s word is desired. When making major sales or entering into major contracts, surety bonds are one way that Colorado businesses can provide the other party with an additional guarantee.

Surety bonds serve as an additional assurance from one party to another. Should the business that purchases a bond fail to meet its obligations, the bond may compensate the other party.

What Colorado businesses need to have a surety bond insurance policy?

Surety bonds are required for certain major purchases and contractors. Auto dealerships, construction companies, and fiduciaries in Colorado might get surety bond insurance.

These bonds are required by state law in some situations. In other situations, commercial customers might only work with businesses that obtain a bond.

Get a Quote

“The team at Jump Suit was fantastic helping my insurance agency with our new responsive website. I highly recommend them to anyone serious about their business.”

“Jump Suit Group took my agency website and absolutely hit it out of the park! Now I have real inbound leads flowing through my website straight into my producer’s laps”

“I finally found an agency that cares about me. They delivered an incredibly sharp looking website that actually generates new business.”

What types of surety bond insurance are auto dealers in Colorado required to have?

State law generally mandates that both auto dealers and vehicle salespersons have a surety bond. Dealerships are normally required to have an auto dealer bond of at least $50,000. Individual salespeople normally need a salesperson bond of at least $15,000.

Premiums for these bonds typically cost a fraction of the bond’s value, and they’re often paid on an annual basis. Many auto dealerships may be willing to pay for each of their salespersons’ bonds.

What types of surety bond insurance do construction companies purchase?

Construction companies sometimes need to purchase bonds when working on commercial buildings, infrastructure, or other major projects. Different bonds are often needed during different stages:

- Bid Bond: Might guarantee that a contractor honors their construction bid, proceeding with the project if selected.

- Performance Bond: Might guarantee that a contractor completes the project according to the contract’s stipulations.

- Payment Bond: Might guarantee that a contractor pays all wages to their employees and subcontractors.

- Maintenance Bond: Might guarantee that a contractor corrects any defects found in their work after completion of the project.

A knowledgeable insurance agent who’s familiar with these bonds can guide contractors through the various ones they might need at different stages.

What types of surety bond insurance do fiduciaries purchase?

Fiduciaries might need a few different bonds, depending on what exactly their duties are. Some of the main types of bonds that fiduciaries may get are:

- Executor Bond: Typically used if managing the estate of a deceased person who had a will.

- Administrator Bond: Typically used if managing the assets of a deceased person who didn’t have a will.

- Conservatorship Bond: Typically used if managing the estate of a ward.

- Guardianship Bond: Typically used if managing the assets of a minor, or an adult with a significant disability.

An insurance agent who specializes in these bonds should be able to help fiduciaries find the right type of bond for their duties.

Who are the different parties involved in a surety bond?

A surety bond usually involves three specific parties. They are the:

- Surety: Typically an insurance company that provides the financial guarantee.

- Obligor: Typically the business or individual who needs to meet an obligation.

- Obligee: Typically the customer, who may be paid if the obligor fails.

How much does getting a surety bond cost?

The cost of a surety bond varies depending on the bond type, the required bond amount, the history and qualifications of the obligor, and other factors. In most cases, a business will pay some small percentage of the bond’s face value.

To find out how much different insurers will charge for a surety bond, businesses and individuals can compare options with an independent insurance agent. An independent agent will be able to check bonds from several different companies.

Where can businesses and individuals purchase surety bonds?

If you’re in Colorado and need a surety bond, contact the independent insurance agents at The DeLuca Agency. Our team helps with many different insurance products, including surety bonds. We can assist you with almost any type of surety bond you might need.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com